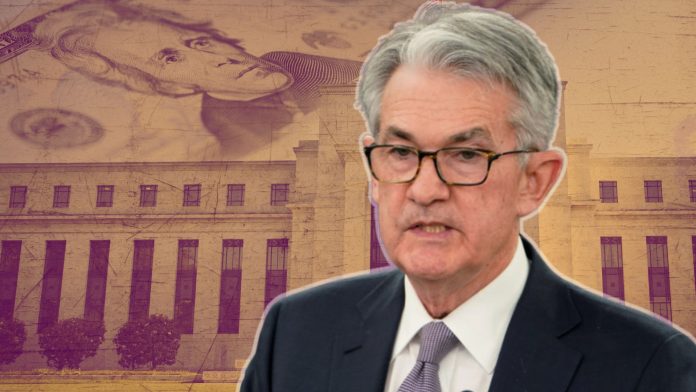

On Wednesday, the Federal Reserve announced its third consecutive interest rate cut of 2024, decreasing the benchmark rate by a 0.25 percentage point to a range of 4.25% to 4.5%. This latest reduction follows a 0.25% cut in early November and a more substantial half-point cut in September, bringing the rate down by a whole percentage point. For small business owners, these rate cuts offer much-needed relief, especially for those managing credit card balances, business loans, and other forms of debt.

Although the Fed anticipates additional cuts in 2025, they’re taking a more measured approach next year. Initially, the rate-setting committee projected that there would be four rate cuts in 2025, but they’ve scaled back their expectations to two. The central bank is treading carefully to stimulate economic activity while managing persistent inflationary pressures. Toward the end of 2025, the Federal Reserve anticipates the median rate to sit at 3.9%, slightly higher than its earlier forecast of 3.4%.

Although inflation has plummeted compared to the heights it hit in 2022–the highest in four decades–progress on reducing inflation has stalled slightly. November’s annual inflation rate hit 2.7%, a slight uptick from the average in September.

Despite the consistent fight to suppress inflation, the Feds don’t believe that they’ll be able to reach their 2% annual target until 2027, a year’s delay from their previous assessment.

In addition, the anticipated presidential transition could also add to their delicate situation. Many small business owners are already bracing themselves for the impact of President-elect Donald Trump’s proposed tariffs. Although the incoming administration has promised to continue cutting rates, the imposed taxes on Mexico, Canada, and China could unintentionally derail the Fed’s efforts and spike inflation further.

The Fed’s rate-cutting committee will meet again in late January; however, rates are anticipated to remain unchanged.