Welcome to another episode of The Female Founder with Bridget Fitzpatrick, Co-founder of ASBN and the CBT Automotive Network. The Female Founder is a show all about helping women grow their businesses and reach their full potential. Each episode will highlight inspiring stories and advice from female entrepreneurs to help you build and grow your business. This show is designed to inspire and motivate other female founders to be the best entrepreneurs they can be.

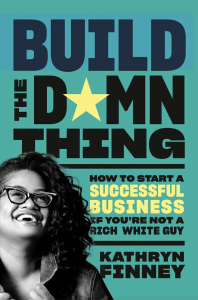

Today’s guest is Kathryn Finney, founder and managing general partner of Genius Guild, a 20-million-dollar venture fund that helps companies led by diverse founders. She’s also the founder of the Doonie Fund, founder and past CEO of digitalundivided, founder of the Budget Fashionista, and author of the new book, Build The Damn Thing, How to Start a Successful Business If You’re Not a Rich White Guy.

Bridget Fitzpatrick:

Kathryn, thank you so much for joining us today.

Kathryn Finney:

Thank you for having me.

Bridget Fitzpatrick:

Now my first question should be when do you sleep, right?

Kathryn Finney:

And I’m a mom too.

Bridget Fitzpatrick:

Oh my goodness. You do it all.

Kathryn Finney:

I sleep. I think it’s important as a entrepreneur and as a leader to take a break. One of the things I’ve learned too, which has been really interesting, is that when you’re a leader or CEO of a company and you stop for a moment and you take a break and truly disconnect, it gives the opportunities for others to step into leadership. It’s really interesting to see, once you get back, who’s been able to really step into leadership roles in your organization because you weren’t there. That has been always the sort of added bonus of a vacation. Not only just a rest, but also to empower other staff members to step into leadership.

Bridget Fitzpatrick:

I was so glad you brought that up because so often we say it’s a great time to recharge, which it is. But then also, that isn’t said as much, so I think that’s great that you bring that point up.

Kathryn Finney:

Yeah, yeah. I think when you’re a CEO, you’re driving so much.

Bridget Fitzpatrick:

Yeah.

Kathryn Finney:

It’s interesting. My staff will often say they get a little break too.

Bridget Fitzpatrick:

That’s true, that’s true. And they can see themselves rise to the occasion as well, so that’s great all around.

Kathryn Finney:

Exactly. Yeah, and be able to get through any sort of back load of work because when you are around and you are CEO, particularly if you’re a public CEO, when you’re there, people are always constantly sending things, constantly needing your attention. So when you’re not there, that means that it’s not as much inbound. Your staff is able to do some of the things that they have to put off for a little bit.

Bridget Fitzpatrick:

That’s a great point. I love that. Now the Budget Fashionista, let’s talk about that for a second. Selling that company made you one of the first black women to have a successful startup exit. Congratulations. And it was hugely successful. Can you tell us why you made the decision to sell?

Kathryn Finney:

I made a decision to sell because I saw that changes were starting to happen, particularly in the online media space. It was going from more service based pieces like what you would read in a Vogue or a Marie Claire or magazine of here’s how you can wear great makeup, here’s how you can do those sort of things to a more personality base, which was the Instagram influencers and things like that. And while I was an early influencer and many probably still consider me one, that wasn’t the direction I wanted to go in. And so as a working mom and CEO, the idea of taking a picture of myself every day, it was so nerve-racking like oh my gosh, I’d have to put makeup on every day, look at charts.

Bridget Fitzpatrick:

I get it.

Kathryn Finney:

So I saw that change was happening and also wanted to do something that was more startup oriented. So I sold it and it was really transformative in many ways. I think there are not very many women at that time, let alone black women, who could sell their company, particularly in the tech startup. And so to be able to see the economic impact of that was really quite significant and the freedom it gave me. I believe that entrepreneurship really gives you a certain level of freedom. It’s incredibly hard. It’s the hardest work you could do, but there’s a freedom that comes with that. And I saw by being a successful entrepreneur, I was able to sort of dictate the life that I wanted to live. So selling it opened up all these possibilities and I went from there, started digitalundivided. While I was working with another woman, led startup called BlogHer that also sold. Sold for a lot more than I sold because it was venture backed.

But it was incredible to be able to do that and to be able to choose what spaces I wanted to be in. I talk a lot in the book about the power of entrepreneurship for those who aren’t rich, white guys. How that opens up the ability for us to be able to dictate the spaces we want to be in and to be able to live the life that we want to live. All of us want to live a creative life in which we can control and entrepreneurship is really the path that helps us get there.

Bridget Fitzpatrick:

Definitely.

Kathryn Finney:

So selling it and doing digitalundivided, which is social enterprise, that I started and founded and seeing the early part of this immersion of diverse founders, when I started there was only one black woman VC in the U.S.

Bridget Fitzpatrick:

Wow. It’s crazy.

Kathryn Finney:

Now there’s more, thankfully. I’m glad I’ve included in those ranks.

Bridget Fitzpatrick:

Yes.

Kathryn Finney:

We did a report called ProjectDiane, and the first year we did it, we could only identify 88 black women led startups. This was in 2016, out of the thousands and hundreds of thousands of startups overall. Black women, at that time, had raised only $34,000 on average for their startups where mostly male, mostly white, failed with startups. These are not the successful startups based on the average 1.4 million. So we weren’t raising enough to even fail properly. We weren’t giving that runway. And so starting digitalundivided allowed me to really get a front row seat into what the problem really was. It’s complicated. It’s complex. It’s not just one solution. But definitely money was a big challenge and the lack of funding and support and more importantly, the lack of runway.

And so in Build the Damn Thing, I talk about how as a other, what I call builder, it’s going to take you longer to fundraise. It is. It’s going to take you longer to fundraise and you’re going to have more complex issues. So you really have to think about things differently than if you were your white male colleague. And so are you doing things like preparing yourself mentally to be able to go into rooms where people may frankly not think that you belong? And how do you prepare yourself?

Bridget Fitzpatrick:

It’s a big one.

Kathryn Finney:

Right? How do you make sure that you have the runway, the economic and also mental runway to be able to build the company? Where do you seek funding? What is venture capital even? I think those of us in VC tend to forget that most people have no clue what VC is.

Bridget Fitzpatrick:

Right.

Kathryn Finney:

The normal person doesn’t know what a venture capital is. And so being aware of that and what does that mean and is venture capital even the right type of funding for your company and all those things that I talk about in the book.

Bridget Fitzpatrick:

And you also are founder of the Genius Guild. You help and you help diverse communities raise capital. Correct? And you started this in 2020?

Kathryn Finney:

Well, Genius Guild, we are a VC fund and we invest. So we invest in exceptional founders who are diverse founders who really are in sort of the healthy space, meaning they’re building innovations and things that help make communities healthy, particularly urban communities. So a number of our investments are in health. We have a couple upcoming investments in clean tech, which are really, really excited. We have a one investment also in the supply chain because that impacts all of us, something called Stimulus. It works with major corporations in helping them manage their diversity supplier chain channels.

Another one of our amazing investments is in Health & Her. It’s a health platform that focuses on culturally competent health information for women of color. They do a lot of work with Blue Cross Blue Shield and other sort of healthcare companies. We have a couple of new investments in child mental health. Another investment that is in clinics and urban areas is currently in four locations. It’s going to be in the top 25 MSAs by the end of next year. So very active venture investor. We invest usually at the later precede-cede stage. So usually after you’ve had your idea and you’re moving in a little bit, that’s when we come in. I always love for founders to pitch me no matter where they think they’re at. Let me say no. Don’t say no for me.

Bridget Fitzpatrick:

Yeah, that’s great advice.

Kathryn Finney:

You may have an idea that’s going to be great.

Bridget Fitzpatrick:

That’s good advice. Now you have a lot of experience in the tech world. How has the experience been as a woman in tech?

Kathryn Finney:

A lot has changed having been in this space for a very long time. I’m an OG, even though I’m not like that old. I’ve been here for 20 years. I was talking to a colleague and we were talking about just the olden days of Web 2.0. If you can remember, that was the old days. I went to a conference in San Francisco and it was in downtown San Francisco at the conference center. There was a line around the bend for the men’s bathroom. There was no line for the women’s bathroom. And that never happens-

Bridget Fitzpatrick:

Never happens.

Kathryn Finney:

It’s tough when you’re at a tech conference in San Francisco in 2008. Right?

Bridget Fitzpatrick:

Right.

Kathryn Finney:

So things have changed drastically from that time point. There still seems to be a funding challenge though in the venture capital world in getting funding to women. Actually the amount raised by female founders actually went down a bit last year. The amount raised by people of color has also contracted a little bit in the past year. That’s really concerning because you had nowhere to contract to. Right?

Bridget Fitzpatrick:

Right.

Kathryn Finney:

It really should be rising.

Bridget Fitzpatrick:

Right. It was already so low.

Kathryn Finney:

Already so low. So it is still a challenge. I think the solution is having more investors like myself. We can see opportunities in markets that frankly my white male colleagues can’t because they just don’t understand the market, but I do and I see the opportunity and I can see it really early. I was talking to the Illinois Growth Fund, I live in Chicago, and it’s a group of PE and other VCs who are mostly men, mostly white guys, and said, “You don’t need to understand the market. You need to co-invest with me because I do. That’s what you need to do. You don’t need go hire-”

Bridget Fitzpatrick:

They can’t figure it out, yeah.

Kathryn Finney:

You can’t figure it out. Just co-investment with me.

Bridget Fitzpatrick:

Right.

Kathryn Finney:

Recognize that I understand the opportunity and that this is an opportunity for you. And if you’re not comfortable in this market, you don’t know enough, but you want to get involved, co-invest with someone like me. I think that’s really the way that we sort of start to open up these doors. And then also funding more women VCs. We need a lot more. There are a number that have started, which is really exciting. There’s a lot of groups and cohorts I’m a part of other women VCs and we share deal flow, we share resources because in venture capital, you really do need other investors. You don’t ever just invest in someone’s raise a hundred percent yourself. It’s usually three or four or five other investors that you’re investing with.

Bridget Fitzpatrick:

Right. Yeah, you’re a team. Now you’ve said before that you found yourself as one of the only black women working in an environment dominated by men. Was this the catalyst to wanting to help other women of color?

Kathryn Finney:

Definitely, my experience in the startup world influenced my real mission to make sure that all of us had the opportunities. I saw the impact of selling my company on my own personal finances. Very rarely do we as women, people of color have the ability to dictate our lives. But creating that company and selling it gave me the financial cushion that I could dictate my life. I could dictate the life that I wanted to live. That was incredibly powerful. So that gave me choices and it gave me options. That meant that I could go to the places I wanted to go. It meant that I could leave the places I didn’t want to be in. When I sold my company, the first thing I did, because I was nervous because I don’t know if I thought they were going to take the wire back or whatever, but-

Bridget Fitzpatrick:

I’m sure.

Kathryn Finney:

Right? Nothing came in. I just got stared at my bank every day and my mother is like, “You need to do something for yourself. Don’t save it all. Take a part of it.” We took a two month trip to the South Pacific and went to New Zealand and Australia and to Fiji.

Bridget Fitzpatrick:

Good for you.

Kathryn Finney:

It was this big trip. I’m from Minnesota and we don’t really spend money like that. I was so, so nervous, but it was the best thing that I ever did for myself.

Bridget Fitzpatrick:

That’s great.

Kathryn Finney:

But I wouldn’t have had that freedom if I hadn’t been a successful entrepreneur because I wouldn’t have been able to take that time off. Work wouldn’t have let me do that.

Bridget Fitzpatrick:

Mm-hmm. For sure. For sure. Now you’re talking about some of the unique barriers that black women founders and entrepreneurs face in tech and entrepreneurship. To follow up on that, how do you hold investors and big tech companies accountable as it relates to women and minorities in tech and entrepreneurship?

Kathryn Finney:

Yeah, I think it’s really important for them to understand the markets and not just from a marketing branding standpoint, but the real sort of R&D, research and development, the real possible channels for opportunities in new markets. So not just, this is great branding, we want to show that we’re diverse, that we want diverse customers, but that we actually see some products and businesses that can help our core businesses. I think we’re starting to have those discussions. It’s happened a lot in beauty because that’s pretty obvious now, but it hasn’t happened in all the other markets. I think it’s starting to happen a little bit in health a little bit too now, especially post pandemic and seeing who are the biggest consumers of healthcare, how much are they spending, all those sort of things that you are seeing the conversations change. But you really need to work with corporations in understanding the real business opportunity outside of branding and marketing. Once we start to get that and we start to chip away, then we’ll start to see even more investments from the corporate side.

Bridget Fitzpatrick:

Great. Great. Now changing gears a little bit, as founders, we have to work really hard to find the lessons in our failures. So can you think of a time in your career when a moment that seemed like it have been a failure worked out in your favor?

Kathryn Finney:

Oh gosh, there is so many different times.

Bridget Fitzpatrick:

I know. It’s probably hard to pick one. As an entrepreneur, I know myself.

Kathryn Finney:

In my early career as an epidemiologist, I worked for an international epidemiological organization and it just was not working out. I was working with someone who was a bit scattered and I found myself, this Yale trained epidemiologist, almost being a high level executive assistant, just researcher focused. And then also being an academia, oftentimes the junior person does the most work, but you get none of the credit. So you write these papers and barely could I get my name on it. It would be a big deal, but I did all the work, but everyone else’s name would be on it. And so that just really, really annoyed me. So I had to talk and essentially, I don’t want to say I was fired, but it was definitely mutual to go. At that same time, I had just started the Budget Fashionista, had just started the Budget Fashionista. And so in ways it seems like, oh, that was bad. Within a year, I was making four times as much as I was making at this other. And then ironically, about a year later they called wanting me to come back and I was like, “Absolutely not.”

Bridget Fitzpatrick:

No, sorry.

Kathryn Finney:

Absolutely not. But it seemed, at the time, especially when you come from resource poor communities like I do, it seems that loss of stability is the end of the world. I think many of us have experienced that when you’re either laid off, something happens to a job, you lose your job, that stability or at least perceived stability, because a lot of times it will never really stable, it really impacts you. And so it was a little nerve-racking for me and I had to rely on my own wits. I was like, “You know what? I’m going to give this thing a try. Maybe this is a blessing or a sign. Let me give this blogging thing of try and see what happens,” and here I am in front of you today.

Bridget Fitzpatrick:

Yeah, definitely a blessing in disguise there, for sure.

Kathryn Finney:

Yeah.

Bridget Fitzpatrick:

Now congratulations on your book, which was just released and hit the Wall Street Journal Best Sellers list in its first week. Congratulations. I love the title, Build the Damn Thing, How to Start a Successful Business If You’re Not a Rich White Guy. Talk to us about where the title came from and what the book’s about.

Kathryn Finney:

It came from years of building companies and years of working with women and people of color who are building startups and just noticing the rules are different for us. They’re just different. I mean, I think the whole Adam Neumann WeWork situation clearly illustrates exactly what I’m talking about of just how different the rules are for us. And all the business books I had read when I was building my businesses, they never talked about that. No one talked about the challenges you have. I was speaking to someone when junior skill was first announced and there was a big article in Forbes about Kathryn Finney raises 10 million dollars or 5 million dollars. Family members saw that and many were like, “Do you think you could loan me some money?” Or things like that and how do you navigate that?

I never heard or read any sort of advice on how to handle that. How do you manage that family member? That happens when you come from resource communities and how do you explain to them, it’s really money for me to invest. It’s not necessarily 10 million in my bank right now that I could just write random checks to people. How do you navigate that? I had never read about that. I never read about how when you are a builder, which is what I call everyone who really has to build both their networks, their community, and their company, how do you get the mental fortitude to be able to do entrepreneurship and also deal with the sexism, racism, whatever it is that you’re going to face, at the same time?

Bridget Fitzpatrick:

Right.

Kathryn Finney:

Because being an entrepreneurs already hard regardless of your race, your gender, but then you add on that layer and it just becomes so much infinitely harder. I talk about creating your personal advisory board, which is something that I did and it’s just we all have advisory boards and boards for our companies, but this is an advisory board for you. They’re in the business of you and they want you to succeed and win. Who are those people that should be in that? For me, I talk about my mom, who very good at redirecting those family members who want million dollar loans and saying, “No.” She’s a 75 year old black grandma. No one’s going to-

Bridget Fitzpatrick:

Hate. Yeah.

Kathryn Finney:

We also say… I have a quote, the movie, Taken, with Liam Neeson.

Bridget Fitzpatrick:

Oh yeah. Is that her?

Kathryn Finney:

She has this particular skill set that she’s developed for many, many years.

Bridget Fitzpatrick:

I love that. That’s the best part of the movie.

Kathryn Finney:

But I’ve never read a book that talked about that because I still want to maintain relationships with my family. I want them to still love me. I just am not writing that check. And so how do I do that in a way that still allows me to go to the family reunion? Because that’s important to me.

Bridget Fitzpatrick:

Yeah. These are things that you probably don’t anticipate. The payday’s coming and there’s going to be an adjustment, but you don’t think about those things and how you’re going to handle very close relationships.

Kathryn Finney:

How do you know when to leave your job if you come from a family in which you don’t have a cushion?

Bridget Fitzpatrick:

Yeah.

Kathryn Finney:

Maybe you are from a family that’s economically challenge. Again, this is regardless of really definitely race and gender, but it’s more of a class issue, right?

Bridget Fitzpatrick:

Yeah.

Kathryn Finney:

How do you know when you can leave your stable job? I call it your exit number. How do you figure that out? The point in which you can leave and still be able to maintain the basic necessities you need to live. I had never read a book that talked about that. The book always assumed that you would have money from somewhere to take care of yourself, but what if you don’t?

Bridget Fitzpatrick:

Right.

Kathryn Finney:

And a lot of people don’t. Right?

Bridget Fitzpatrick:

Right.

Kathryn Finney:

And they were all written by these dudes that had this sort of level of success, and most of them were rich white guys. The interesting part about the book and the response to the book has been the number of rich white guys who like the book.

Bridget Fitzpatrick:

Oh, that’s great. That’s great. It’s good they recognize, yeah.

Kathryn Finney:

Now, one of our endorsers is Steve Case, who’s the founder of AOL. I mean, he’s grand poobah of rich, white guy. And he shared, “This book says all the things that I say to the companies, diverse companies we’ve invested in, but it says it in a way in which they can hear, because when it comes from me, it’s heard in a different way than it coming from you.” And I was like, “Great. So now you can give all of your investments a copy of this book.” He’s like, “Yeah. Essentially that’s what we’re doing is here’s the book, read it. So now you have context for why I’m saying what I’m saying to you.”

Bridget Fitzpatrick:

That’s so important for them to read it, so important.

Kathryn Finney:

So important. And so I found that I’ve had a number of conversations with white male VC colleagues who are like, “We love the book.” I’m like, “Are you offended by the title?” They’re like, “No. As a rich white guy, I know that I don’t know what it’s like to be you and I’m okay with that.” I’m making these investments and I want them to be successful and so this book is a great tool to help them do that.

Bridget Fitzpatrick:

That’s great. Now, any other takeaways that you want your readers to walk away with from the book?

Kathryn Finney:

Yeah. Well, one big thing is that it’s also fun. I think oftentimes when you hear of a business book, you think it’s going to be all sort of stodgy and stuff like that. I wrote it for people like myself who are entrepreneurs, who are creative, who are excited, but also don’t have a lot of time, so you don’t want to sit and read something that’s not going to be at least sort of indicating you’re going to come away with stuff. So I would say that we have quotes from BTS to Cardi B, I mean, all in between.

Bridget Fitzpatrick:

That’s great.

Kathryn Finney:

And then also that it really is a manual that you can come back to. So it’s not like you have to read all the way through and you’re done. It’s broken up into steps for a reason.

Bridget Fitzpatrick:

Nice.

Kathryn Finney:

So it’s want to go back to any part, you can go back to any part you want to go back to-

Bridget Fitzpatrick:

Nice.

Kathryn Finney:

And reference. It’s meant to be that way. My hope is that people really mark it up. Someone sent me a picture of their book and head all these little tabs and I love it. That’s exactly what I wanted.

Bridget Fitzpatrick:

That’s great. That’s great.

Kathryn Finney:

You can easily go back to mark it up, highlight it, write in the margins, do all those sort of things.

Bridget Fitzpatrick:

That’s the best, yeah. Those are the best business books, I think, when you can keep them around, reference constantly.

Kathryn Finney:

Yeah.

Bridget Fitzpatrick:

Now, you were also at first for your publishing company, correct? I think I read that you were the first black woman to write a business book for them. Is that correct?

Kathryn Finney:

Yeah. Yeah.

Bridget Fitzpatrick:

That’s great. Breaking Barriers, I love it.

Kathryn Finney:

2022, I wish that wasn’t the case, but the success of this book is helping others.

Bridget Fitzpatrick:

Yes.

Kathryn Finney:

And it’s creating a path. That’s been the story of my life is being this trailblazer pioneer, and then it opens up the path to others to come after me, and I’m really, really excited. There’s a whole slew of new business books that are going to be coming out and the next two years or so because of the success of this book.

Bridget Fitzpatrick:

Definitely. Definitely. So what’s next for Kathryn Finney?

Kathryn Finney:

Investing and working with my portfolio companies. We’re knee deep into ending the year. A lot of our investments are raising. We’ve had two that just closed their rounds in this down market, which has been pretty amazing.

Bridget Fitzpatrick:

That’s great.

Kathryn Finney:

We have another that’s going to close a pretty large raise in the next month or two. We have three or four new investments that we’re onboarding this fall. So it’s a busy, busy, busy, busy, busy fall. I’m still talking with amazing people like yourself about the book and starting to think of book two and what that’s going to be. Yeah.

Bridget Fitzpatrick:

Well, I can’t wait. I can’t wait. Thank you so much for sharing your story and great advice with our viewers today. We really appreciate it and hope that we can have you on again for a follow up soon.

Kathryn Finney:

Definitely. Thank you for having me.

Bridget Fitzpatrick:

Yeah, thanks, Kathryn.

ASBN, from startup to success, we are your go-to resource for small business news, expert advice, information, and event coverage.

ASBN, from startup to success, we are your go-to resource for small business news, expert advice, information, and event coverage.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest business news know-how from ASBN.