Top Stories

Google recently launched its new shopping features that will make it simpler for retailers to display crucial shop information using generative AI. Google’s Small Business Attribute, Knowledge Panel, and Product Studio are focused on helping small businesses put their “best foot forward and connect with as many customers as possible,” says Google’s vice president and general manager for merchant shopping, Matt Madrigal. Read More

U.S. Small Business Administration (SBA) Administrator Isabel Guzman revealed new data that showed a rise in SBA-backed loans to women-owned businesses. In fiscal year 2023, lending climbed by almost 70% to a startling $5.1 billion. Concerning credit accessibility, the SBA’s lending programs are a beacon of hope in an increasingly dire situation. By bridging market gaps with government-backed loans on advantageous terms, they make sure small businesses are not left high and dry. In terms of data, there has been a 70% increase in loans to most women-owned small businesses since FY20. Guzman’s announcement comes on the 35th anniversary of the Women’s Business Ownership Act of 1988. Read More

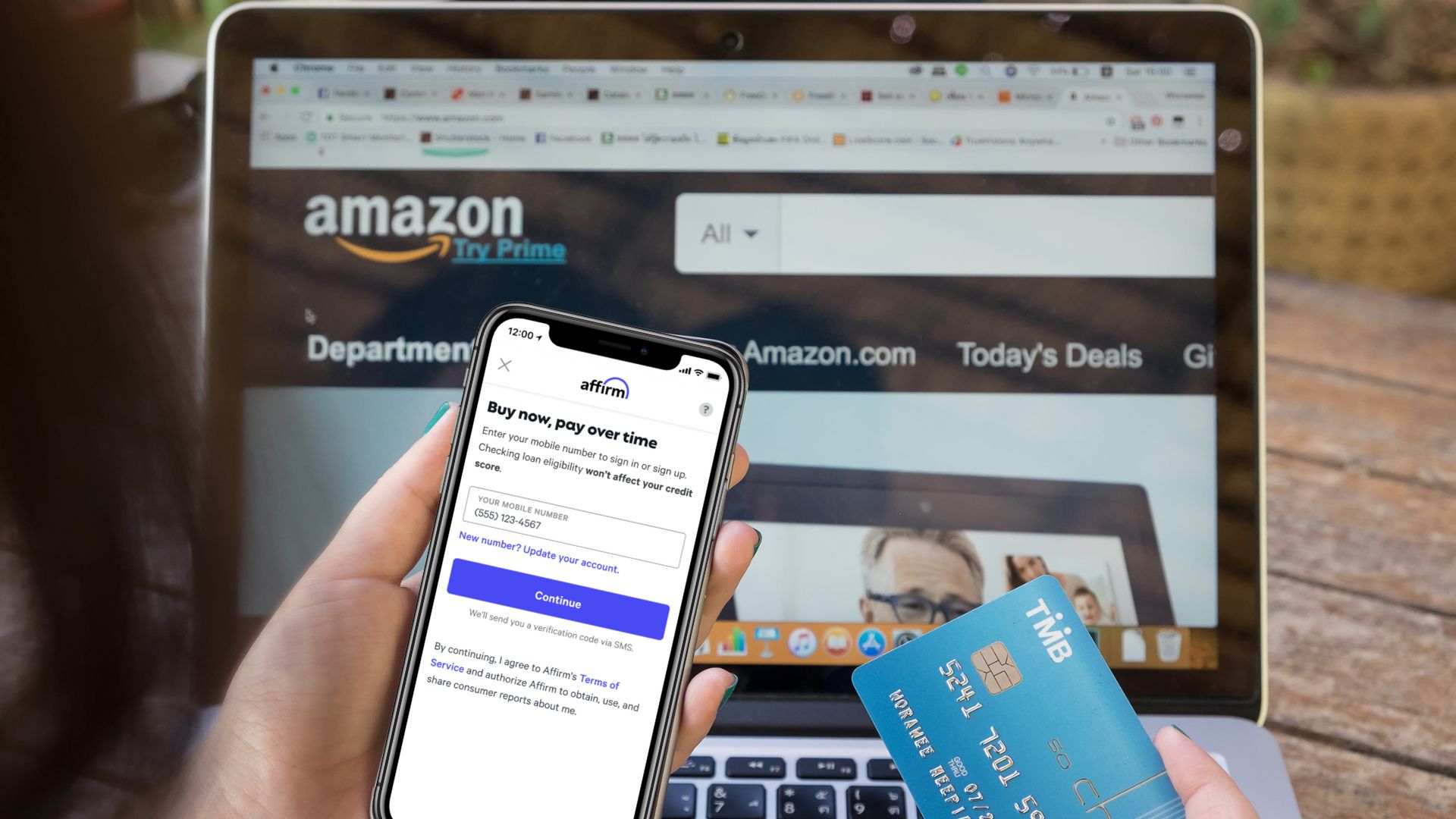

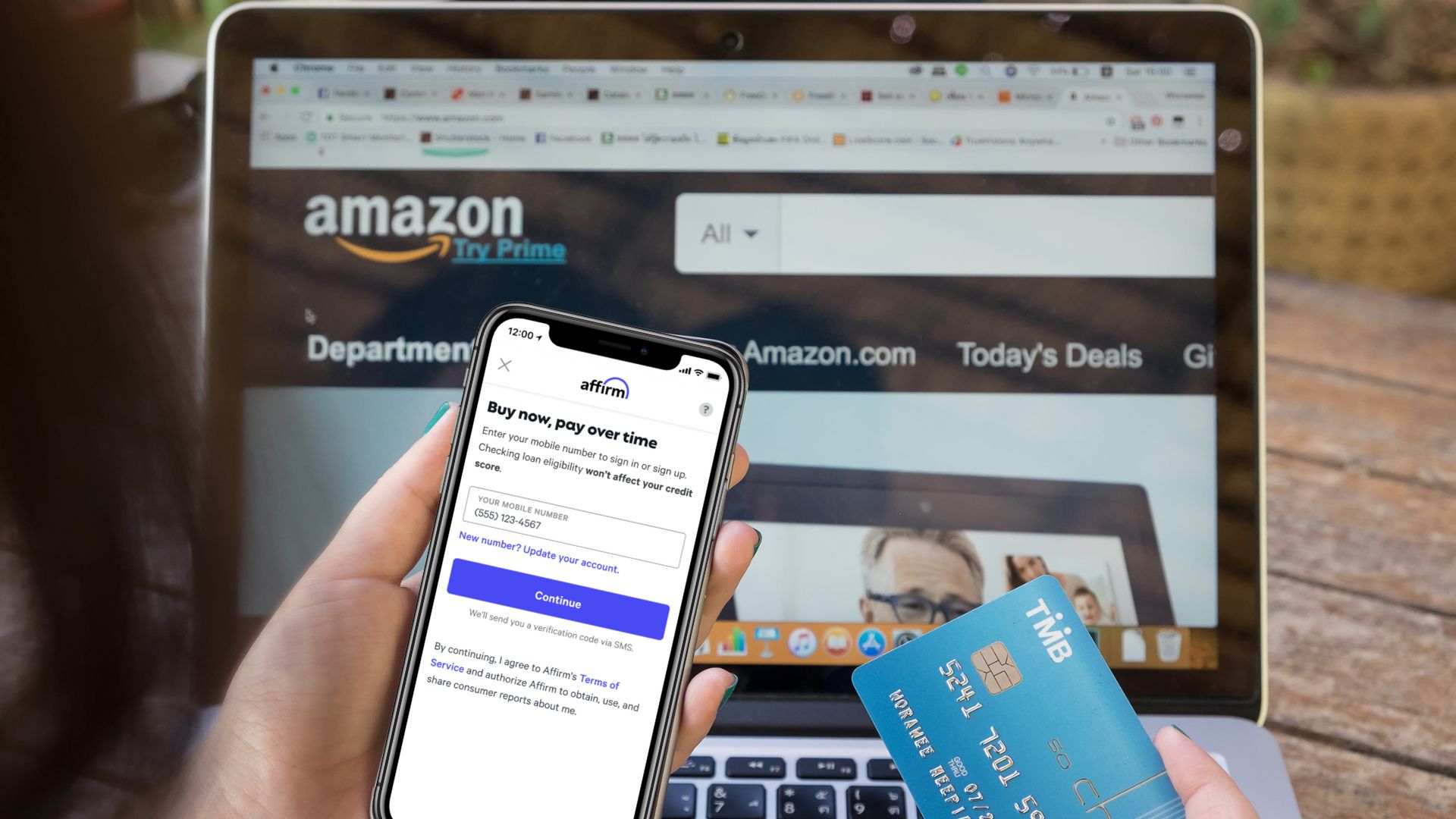

Amazon Business is now offering buy now, pay later with Affirm. The partnership marks the debut of Affirm’s business-to-business pay-over-time solution for sole proprietors and opens new avenues to funding for small and medium-sized businesses as traditional financing sources dry up. The checkout with Affirm option will be available to all qualified Amazon Business single proprietor customers by Black Friday. Read More

Senate blocks small business lending rule opposed by NFIB

The Consumer Financial Protection Bureau recently proposed the CFPB 1071 small business lending rule that mandates financial institutions to gather, maintain, and submit certain lending data. However, the National Federation of Independent Business flagged the rule as a possible barrier to the expansion of small businesses. NFIB vice president of federal government relations Kevin Kuhlman stated, “Small businesses are already inundated with federal paperwork when opening and running a business and applying for loans. This rule could restrict small businesses’ access to credit and have a detrimental effect on credit unions and banks nationwide.” Read More